Global Power Struggle: Ukraine Conflict Sparks New Geopolitical Alliances

Explore how the Ukraine conflict reshaped global alliances, with North Korea and China's involvement influencing economic and defense strategies. A pivotal shift impacting investment decisions.

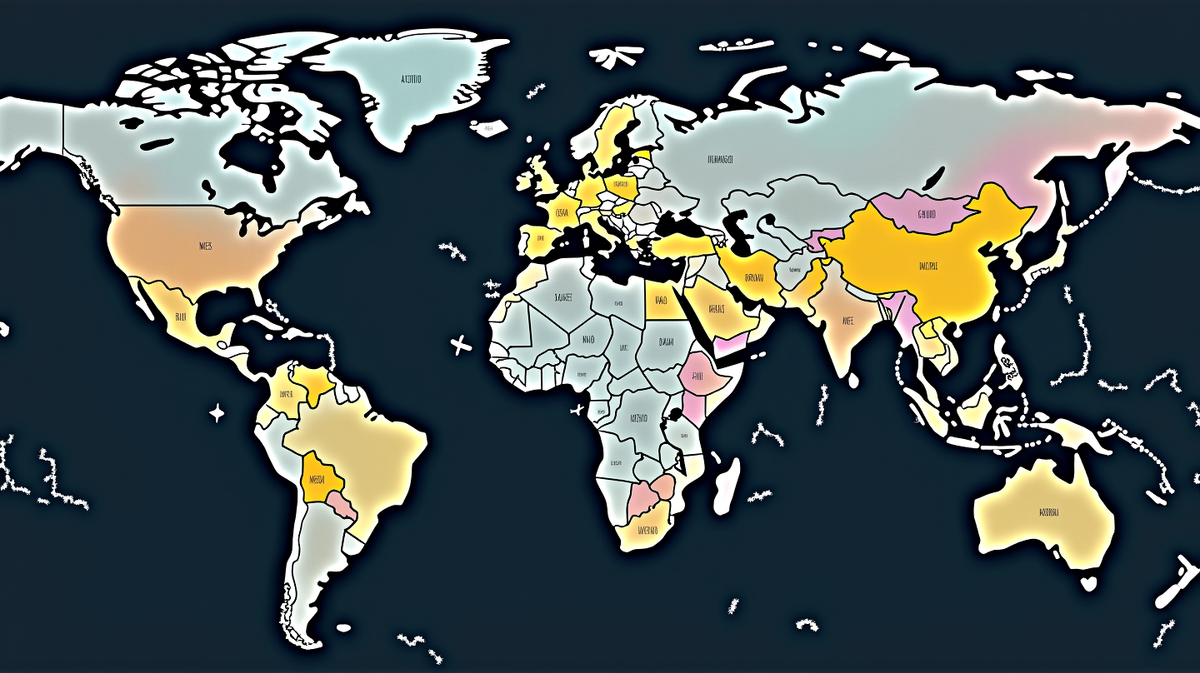

The Ukraine conflict has dramatically evolved beyond a regional skirmish, igniting a global ideological battle that intertwines the worlds of democracy and authoritarianism. At the forefront of this geopolitical shuffle are formidable alliances and opportunistic investments, painting a vivid landscape of shifting power dynamics.

Unprecedented Alliances and Power Plays

The conflict has metamorphosed into a chessboard of international maneuvering with North Korea sending troops to Russia’s strategic heartlands while China fortifies its economic ties with the Kremlin. This development forces diplomatic recalibrations as nations line up according to their geopolitical leanings, influencing global markets and security policies. According to AInvest, these alliances emphasize how traditional alliances can transform into unexpected coalitions in the face of complex geopolitical unrest.

EU’s Robust Stand: Opportunities vs. Risks

The European Union has stepped into a prominent role, committing billions in military support to Ukraine, thus reinforcing its strategic alliance with the United States. However, this defense spending surge could disrupt the EU’s fiscal harmony, a crucial consideration for investors wary of potential debt accumulation in heavily indebted member states like France and Italy. Nonetheless, with the rising tide of European federalism, the alignment in strategic priorities offers fertile ground for those investing in defense and technology sectors.

Defense and Energy: Twin Pillars of Investment

Energy resilience and defense technology have emerged as the new frontiers of investment in response to the war’s demands. Europe’s trillion-euro strategy for modernizing its energy grid signals a formidable shift away from Russian dependencies, paving avenues for investments in green technologies. Ukraine’s ambitious plans for renewable energy expansion further align with this movement, offering lucrative opportunities for forward-thinking investors.

Strategic Investment in Ukraine’s Reconstruction

Ukraine’s commitment to solidify its defenses mirrors its intent to thwart Russian incursions with what’s dubbed as the “steel porcupine” strategy. The EU-supported Ukraine Investment Framework envisages channeling funds into infrastructure and green energy, positioning Ukraine as a beacon for sustainable investments. PwC’s estimates for Ukraine’s extensive reconstruction starkly highlight the delicate balance between defense and development for astute investors exploring this revitalized economy.

Setting Investment Priorities for a New Era

For investors, the shifting focus to geopolitical resilience is paramount against the backdrop of these giddying changes. Crafting diversified portfolios that blend defense, energy, and technological allocations will be instrumental in hedging against sector-specific volatility. As Europe steps into a coherent strategic role and Ukraine builds on unprecedented international support, balancing such investments will not only mitigate geopolitical risks but could also yield substantial returns as this era unfolds.

Conclusion

The perpetual state of conflict in Ukraine has redefined how global risks are perceived and managed. By aligning investment strategies with geopolitical realities—through energy transitions, defense innovations, and reconstruction opportunities—investors are well-positioned to capitalize on an evolving world order that holds both challenges and promises in equal measure.