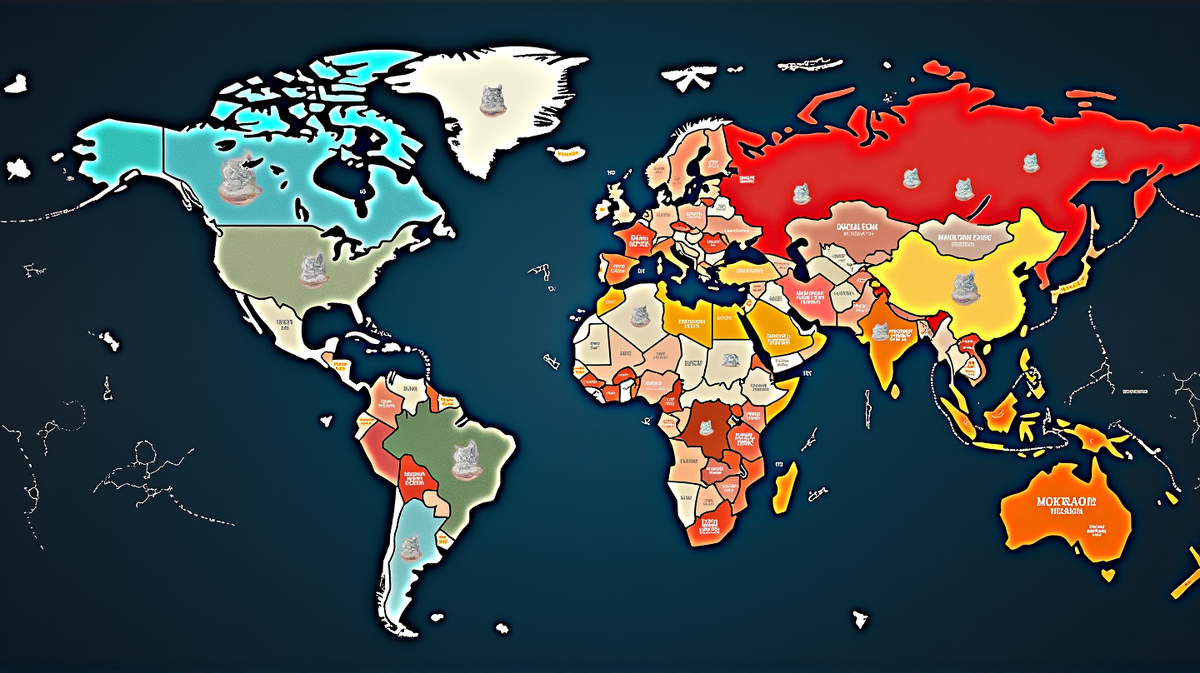

Under Fire: How Russia Circumvents Sanctions Using Chinese Financial Channels

Despite 6000+ U.S. restrictions, Russia cleverly uses Chinese banks, Alipay, and loopholes, challenging the effectiveness of global sanctions.

The Power of Economic Sanctions

Economic sanctions continue to step into the limelight as the predominant force wielded by the United States in response to global transgressions. This economic arsenal gains prominence in a world shadowed by nuclear threats. The strategic use of financial restrictions is designed to coerce nations like Russia into altering geopolitical courses. According to Deccan Herald, punitive measures, such as cutting off access to the U.S. dollar, are expected to exert enormous pressure.

Russia Continues Its Financial Ballet

Despite being shrouded under the umbrella of global sanctions — some 6,000 entities are listed due to Russia’s actions in Ukraine — Russia’s economy dances on the international stage. The New York Times highlighted substantial settlements related predominantly to non-compliance by financial institutions. Yet, interestingly, Russia retains a robust trading portfolio by leveraging loopholes and unestablished penalties against involved institutions.

China: An Unsanctionable Ally

Moscow’s relationship with Beijing has deepened, with China providing a financial life raft. As denoted by expert Martin Chorzempa, the ramifications of imposing sanctions on Chinese banks pose a significant threat to global financial stability. This situation renders China practically untouchable due to the intertwined nature of international trade and supply chains, which, if disrupted, could escalate costs for American consumers.

The Unseen Channels of Alipay

While traditional sanctions positioned Russia’s VTB Bank away from the SWIFTs of global finance, innovation saw Russian currency funneled through Alipay, establishing discreet financial channels, until a detailed inquiry prompted a disappearance of such publicity. Alipay became a pivotal backdoor, subtly facilitating unfettered transactions beyond restricted avenues.

Complexity in Enforcement

The complexity persists, as entities flaunt their ingenuity in countering sanctions. The presence of Hong Kong-based exhibitors selling restricted technology at prominent Russian trade shows underscores this persistence. Furthermore, networks interweaving Russian VTB accounts and Alipay payments demonstrate a resilient financial narrative that transcends imposed impediments.

The Future of Global Sanctions

President Joe Biden made attempts to clamp down on transactional loopholes involving Russian and Chinese entities, yet these strides have mostly impacted smaller, non-prominent intermediaries, leaving powerhouses like Alipay largely untouched. Sanctions continue to require robust, well-thought enforcement to adapt to the ever-evolving geopolitical landscape, where the players are as increasingly unfathomable as the game itself.

Europe’s Limited Reach

As discussed by Maria Snegovaya from the Center for Strategic and International Studies, European sanctions, although enacted, grapple with inadequate enforcement mechanisms. The European Union’s financial leverage falls short of the requisite power to maintain adherence to these global mandates, highlighting the broader global effort needed to enforce steadfast compliance.

Sanctions, as a tool of global policy, must adapt to complex international dynamics in order to fulfill their intended purpose — persuading nations towards peace and global harmony.