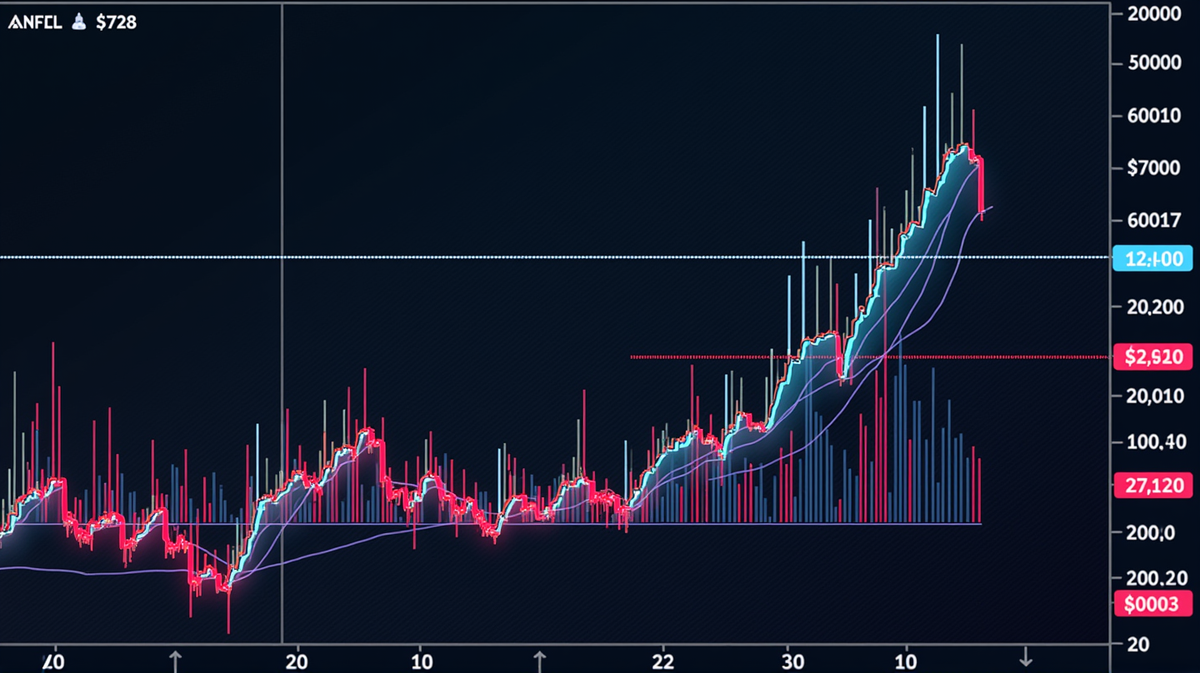

AppLovin Corp Faces Critical Resistance Point at $728 Mark

AppLovin Corp is at a pivotal resistance point, with potential for a breakout at the $728 mark, amidst mixed trends.

Understanding the Resistance

AppLovin Corp (NASDAQ:APP) has found itself in a challenging spot, firmly entrenched at the resistance level of $728. Traders watch closely, pondering whether this level might succumb to an upward push. Resistance represents a price point full of sell interest, and AppLovin’s current stall has investors speculating over its next move.

The Impact of Market Dynamics

The pressure on AppLovin’s shares is palpable. Their trajectory reflects a classic struggle at resistance - a pivotal meeting point of buyers and sellers. While past encounters resulted in setbacks, the question remains: will the resistance finally break? According to Benzinga, analyzing stock trends across different timeframes could be key in determining the outcome.

Decoding Trend Signals

Market movements are often categorized into short-term, intermediate-term, and long-term trends. A stock that climbs across all these horizons indicates robust growth potential. However, stocks can simultaneously experience multi-directional trends, prompting intense speculation. For instance, suppose a share price jumps from \(10 to \)100 in a year, only to dip to $90 soon after — it reflects a long-term uptrend but a short-term downtrend.

Moving Averages in Focus

Traders often lean on moving averages to foresee resistance breaks. In AppLovin’s case, the 10-, 100-, and 150-day moving averages show a promising upward trend across short to long-term timelines, underscoring the strength of buyers in these periods. Such trends can suggest that the persistent resistance at $728 might eventually give way to higher valuations.

Conclusion

AppLovin is not just the Stock of the Day; it’s a dynamic example of market psychology in action. Will it defy resistance and climb higher, or does its current price foreshadow a deeper pullback? Stay tuned as this unfolding story captivates market watchers and investors alike.